The Industrialization of Agriculture

Part 5—Going vertical

As businesses grow large to take advantage of economies-of-scale and specialization, they also attempt to lower their costs and improve the value of their product through vertical coordination. Vertical coordination is where each stage of the production process of a good (e.g., a wheat farmer grows wheat, a miller mills that wheat into flour, a baker bakes that flour, a wholesaler transports the bread, and a grocery store sells the bread) develops closer relationships with each other. Taken to an extreme, vertical coordination can morph different firms into one large corporation. Tyson Foods is an example. Though Tyson is primarily a food processor, in regards to their chicken meat, Tyson owns some of their own chicken farms. On most chicken farms Tyson will own the chickens and the chicken feed, but the farmer will own the land and buildings, and Tyson will use contracts to exert considerable control over how the farmer cares for the birds. As they have moved into China, Tyson felt the need to construct and operate its own farms, rather than rely exclusively on Chinese farmers who provided inferior and unreliable birds. They are merely doing in China what most chicken processors began decades earlier in the U.S.

As western Europe and the U.S. industrialized, people saw the future not only as huge corporations running large factories, they also foresaw the many different functions involved in producing a good being enveloped by a single company (or at least only a few companies). Some took this prediction to an extreme, like Edward Bellamy in his 1888 fiction Looking Backward, where he predicted that businesses will vertically coordinate and merge with one another on such a large scale that the whole nation would eventually consist of only one gigantic company.

This lecture is the story of vertical coordination, focusing largely on the livestock industries during the twentieth century. It will not only impart lessons on how agricultural firms coordinate to improve product quality, but all the value that is added to food after the farm. We tend to discuss in great lengths what happens on the farm, while what happens at the food processing, wholesale, and retail level is equally important.

After the farm: the food marketing bill

Figure 1—Value added in food and fiber(H1)

We often concentration too much on the farm. Today, 93% of the value of food is added not on the farm but in the industries that provide farm inputs, the food processing industry, and the grocery stores. When the agricultural product is sold by the farmer, it is valued only 20% as much as the food sold in the grocery store, because food processors will spend even more money than the farmer in making the product valuable to consumers. Few households today want raw wheat. Most of us wouldn’t know what to do with it. We want bread flour instead, and if bread is a metaphor for all food, 41% of the value of the bread was created by the farm and farm input industries (like fertilizer and tractors), and 59% was created by processors, wholesalers, and retailers.(H1)

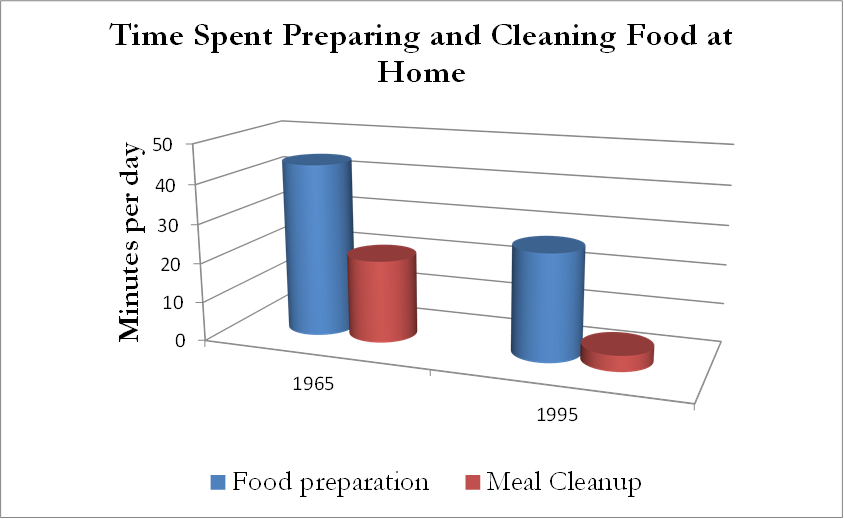

The importance of food processors is relatively new. A century ago most households performed the duties of food processing and cooking. Housewives bought a whole chicken, and themselves performed the preparing, cutting, and cooking of the meat. Today you can buy a whole cooked chicken at Walmart for $5. The chicken is not only cooked, but kept warm and is ready to eat. It is also delicious, in my opinion. Walmart is doing many of the duties housewives did decades ago, so it is not surprising that food in the grocery store is valued higher than in the past. Walmart provides more value than simply cooking the chicken though. They cook it such that you may pick it up warm at 4:30 and place it on the dinner table soon after. This increase in value provided by processors, wholesalers, and retailers, is referred to as the food marketing bill.

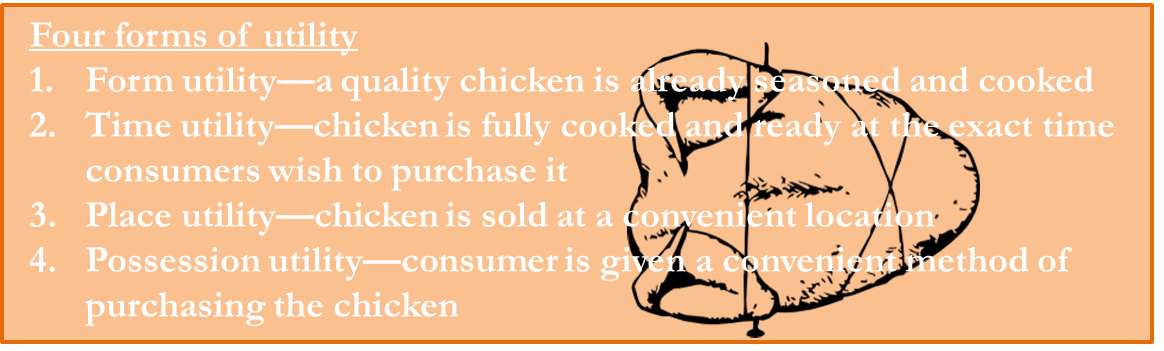

By cooking the chicken, Walmart adds what economists call form utility, as cooked chicken is valued higher than raw chicken. By having it warm and ready at the precise time working families desire it, Walmart adds time utility. By locating the store at a convenient location, and by placing the warm, cooked chicken at the front of the store, so that customers can purchase a chicken quickly, they add place utility. Stores even provide possession utility by accepting credit cards, making it easier for you to take possession of the chicken.

In the past much of this value was performed by the household, but as more women entered the workforce they had less time, and so food companies recognized they could profit by saving households time, and save they did, as households spend far less time preparing and cleaning up after meals in their homes than they did in 1965.

Figure 2—Time saved on food at home(C1)

Consider salad. It wasn’t long ago that to make a great salad one had to buy several different heads of lettuce, wash them, dry them, and then cut the lettuce into salad-sized pieces. This takes a considerable amount of time. Now, you can purchase a salad package like the one below. Not only does it contain cut pieces of lettuce from numerous different types of lettuce, but the package proudly touts, “Washed and ready to eat.”

Figure 3—Ready-to-eat salads

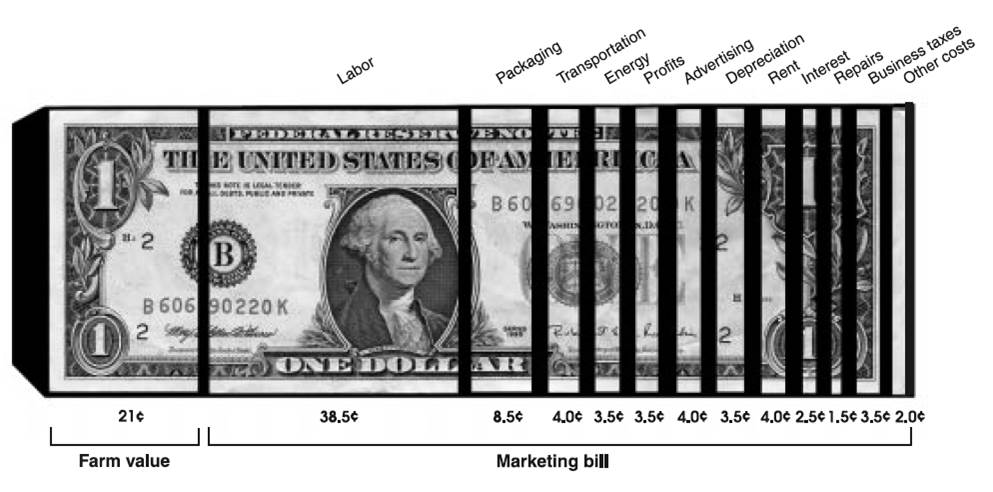

This time saved is not free. Companies incur cost when they process, prepare, cook, store, and package the product, so it is not surprising that the marketing bill, meaning the cost of transforming food from the farm product to a consumer item, has risen considerably. In 1954, the value of the farm product was roughly half the value of the grocery store item. Today, it is only one-fifth as valuable. It isn't that the farm product is less valuable, the opposite is true. The farm product has increased in value over time but the value of food items have risen even faster.

Figure 4—The farm value versus the marketing bill of food(E1)

The figure below is an illustration of where a single dollar spent on food goes. Only $0.21 goes to pay the farmer (and of that $0.21 she must pay her input suppliers). Labor at the processing, wholesale, and retail level is a far bigger component of food. Packaging is more important than transportation and energy. Some may find it surprising that transportation and energy is such a minor cost compared to labor and packaging. The local foods movement is partly predicated on the idea that the transportation of non-local food is large, but as the figure shows, the amount of money saved on shipping food shorter distances would not reduce costs much.

Figure 5—The food dollar(E2)

(The reader might note that there is an inconsistency between figures 1 and 4. It is probably due to different assumptions about the food system.)

Vertical coordination

Now that we have emphasized the importance of food processors, wholesalers, and retailers, it is time to consider the ways in which they coordinate their actions with those of farmers in the food production process.

It makes little difference if a farmer produces a superior chicken if the chicken processor damages the bird, and an efficient chicken processor may have a difficult time competing with chicken processors if their chicken farmers are inefficient. A bread company can only produce a safe product if the wheat farmer applies pesticides according to regulations, and a high wheat price for the farmer partially depends on the bakers’ ability to produce high quality bread. Because the profitability of different functions in the food production channel depends on the performance of other functions, they will attempt to coordinate with each other to ensure a competitive product results.

Over the last century the food production channel has learned to work together more closely, communicate better, and ultimately increase the value of the food to consumers—something we call vertical coordination. The term “vertical” means firms who perform different functions work with one another to coordinate their activities. If we were to describe a group of chicken farmers, all performing the same function of raising live chickens, working together to sell all their chickens in one large batch, that would be horizontal coordination because all the businesses perform the same function in food production. Two bread companies merging would also be horizontal coordination, as they both perform the same function but now come under one management.

Firms have always vertically coordinated to some degree, but the change in the livestock sector has been revolutionary in the last fifty years. The remainder of this lecture will discuss the four main strategies used in meat production: marketing contracts, production contracts, vertical integration, and complex pricing structures.

Marketing contracts in the cattle industry

Slaughter houses are enormous complexes that can only operate efficiently if they have a large and reliable stream of “finished” cattle. Without this reliable supply, they stand no chance of making money, but with it their financial prospects are bright. It should not be surprising, then, that they go to great lengths to secure cattle supplies on a regular basis.

One way beef-packers (entities who slaughter finished cattle and process the carcass into wholesale or retail beef cuts) do this is the use of marking contracts, where farmers agree to provide a certain number of fed-cattle of a particular quality at a specific date, with a negotiated price. Such contracts are popular in the market for vegetables and crops also. In regards to cattle, this negotiated price could be a fixed price agreed upon by buyers and sellers in advance. Other times the negotiated price is a formula. For instance, the fed-cattle industry uses a form of marketing contracts called captive supplies, where the feedlot agrees to provide a certain number of fed-cattle in the future, and agrees to accept a price equal to the current price of fed-cattle at that time.

An example might be helpful. Suppose you are a feedlot and you agree to sell 2,000 head of Angus cattle in two months, each between 1,000 and 1,300 lbs. The contract you sign says in two months you will receive whatever the cash or spot price is at that time. The spot price is simply the price being negotiated for cattle traded on that day, not in advance. If the cash price today is $70 / cwt but in two months falls to $50 / cwt, the captive supply contract then states you will receive a price of $50 / cwt.

The captive supply contracts obviously helps feedlots and beef-packers plan for the future, but they are also controversial in that some cattlemen believe beef-packers use captive supplies to negotiate lower prices. Think of it this way. You are a beef-packer who, today, procures 70% of the cattle it will need in two months by signing captive supply contracts. After two months pass, you must acquire the other 30% from the spot market, and since negotiating a lower price on the spot market reduces the price you pay on 100% of the cattle, you have greater incentive to negotiate fiercely.

Some believe captive supplies are a tool for market power by the beef-packers, and others believe that they are tools that enhance the profitability of both cattleman and beef-packers. Both seem to be true. As the use of captive supplies rise, studies have shown that the price of fed-cattle does fall, but the results are very small, so small that there must be other attractive features of captive supplies that explain their use throughout the beef industry.(W1)

It should be noted that if beef-packers had enough negotiating power to force the price down using captive supplies, they should be able to force prices down using other methods as well. Also, just as captive supplies provide a reliable source of inputs for the beef-packers, it can help provide a reliable market for cattle by feedlots.

Grid-pricing in the beef industry

Beef processors want a specific amount of high quality meat, a specific amount of low quality meat (to be made into ground beef), and they want the cattle to be of a specific weight that is compatible with the machines in the slaughter house. Because beef producers are scattered throughout the nation, and because multiple people may have owned any one cow by the time it is ready for slaughter, it is hard to coordinate these activities verbally. The beef industry’s solution was grid-pricing, where the power of market prices is used to induce cattle producers to raise the ideal cattle.

An example is shown below, where the beef processor is indicating it will pay a certain premium for beef that grades Prime (the highest quality grade), and that it wishes a carcass weight (weight of animal without the head, guts, or skin) between 500 and 950 lbs. They will gladly take a larger or smaller animal, so long as the seller is willing to take the discount dictated by the price structure below.

Figure 6—Example of grid-pricing(N1)

One might think of grid-pricing as akin to a parent giving their toddler candy for using the potty. Although the intent is to manipulate the other party, this indirect manipulation is often more effective than direct force.

Production contracts in the broiler and pork industries

A chicken farmer today really only owns the land and the buildings. The processor retains ownership of the chickens from the time it hatches till it is slaughtered. It not only ships the chicks to farmers to raise, but it also provides the farmer with the feed for the chickens (Note I made the word chicken plural), and perhaps even veterinary services. The farmer’s job is then to make sure the building stays at the right temperature, the automated feeding system is working, and that the broilers’ health is monitored. Such contracts are referred to as production contracts.

In many respects, the farmer has just become the employee of the chicken processor, and that is the point, as it gives the processor more control over the chicken supply. Seeing the success of the broiler industry, the hog industry has evolved into using production contracts also.

These contracts have conquered the broiler and pork industry. By allowing farmers to specialize in fewer activities involved in raising chickens they become better at their job, and just as economies-of-scale and specialization improve efficiency when a business grows large, it does the same thing when firms vertically coordinate. By having more control over the bird genetics and the feed, the processor can make sure they slaughter birds at a very specific and consistent weight. The enormous slaughtering facilities built today can only efficiently process birds of a specific size, so they need farmers to produce a uniform bird. By exerting more control over the type of bird that is slaughtered, it is more feasible for processors to invest in efficient slaughtering plants, which ultimately lead to a more consistent consumer product at a lower price.

By owning the animals, the pork industry has been able to invest in better breeding programs that produce leaner meat, allowing it to advertise pork as the “other white meat.” By owning the animals, chicken processors have been able to sell large chicken breasts nearly identical in size, leanness, and tenderness, such that chicken and turkey meat is nearly as consistent as Campbell's tomato soup.

Critics of production contracts will remark that it represents a continuing “corporate takeover” of agriculture. Though it does take some power away from farmers, by improving the quality of the meat it expands the size of the livestock industry, allowing the number of farmers under production contracts to climb and increase their profitability. Although I have heard some farmers lament how they are forced to essentially work for a corporation, I have heard others stress that they make more money than they ever could as an independent farmer, and production contracts allow them to become really good at the parts of farming that is their responsibility, and this gives them greater reward from their work.

Vertical integration

It might seem that a farmer under production contracts is hardly an independent farmer, and more of an employee of the processor. That is indeed the case, and one might wonder why the processor doesn’t just own the entire farm, paying wage-laborers to care for the animal. This is referred to as vertical integration, where the processor also owns the entire farm used to raise the animals.

Figure 7—Vertical coordination for birds and hogs(M1)

Vertical integration is not a term specific to livestock agriculture, but refers to any instance where a firm exerts ownership of the facility producing the inputs or buying the outputs of another facility. Braums is a fast-food chain in the Midwest, which owns the dairy farms used to produce its milk—that is vertical integration. If Apple purchased the companies used to make its computer chips, then that would be vertical integration also.

An episode of the sitcom 30 Rock recently described vertical integration, but very poorly.

Quotation 1—Dialogue from an episode of 30 Rock

Liz: What’s vertical integration?

Jack: Imagine that your favorite corn chip manufacturer also owned the number one diarrhea medication.

Liz: That’d be great, because then they could put a little sample of the medication in each bag.

Jack: Keep thinking ...

Liz: Aww, cause then they might be tempted to make the corn chips give you [diarrhea]

—30 Rock. 2010. Season Five. Episode 3. You can watch the scene at http://www.criticalcommons.org/Members/BaileyNorwood/clips/30-rock-on-vertical-integration.

What the Jack character is describing is not vertical integration, because the corn chip is not an input into the production of diarrhea medication, or vice-versa. If the corn chip manufacturer owned the corn farm, or if it owned the wholesale company that shipped the chips to grocery stores, then that would be vertical integration.

Conflict and coordination

This article has sought to describe how businesses performing different functions in the food production process work with one another, and it has largely depicted this coordination as desirable. This is intentional, as it reflects the attitude of most agricultural economists that marketing contracts, grid-pricing, production contracts, and vertical integration have all gained in popularity at the same time that food quality rose and food prices fell. Economists generally believe that vertical coordination is usually a good thing.

This coordination is rarely greeted by the public though, and that is because in business, cooperation and conflict go hand-in-hand. At the same time that production contracts have evolved to coordinate activities between the farmer and chicken food processor, the farmer is paid by the processor based on her ability to raise chickens, relative to other farmers. This has been described as a tournament system, and was disparaged as cruel in the recent book The Meat Racket. Yet, if you think about it, if we reverted to a system where individual farmers sold their chickens in a market, aren’t those farmers paid based on their ability, relative to other farmers? If Sally has a higher cost of production than her surrounding farmers, she will be driven out-of-business while those who produce chicken more efficiently remain.

Any time vertical coordination takes place it is likely to give one business or sector more control than another. This, combined with the perpetual conflict and coordination that occurs in the private sector, often earns that sector gaining control public scorn. Sometimes the scorn might be deserved, but let us also acknowledge that sometimes vertical coordination occurs in order to improve the project, and though it might remove some control of a sector, it might simultaneously increase that sector’s profits. After all, chicken meat rose from being a periodic treat to the most popular form of meat in the U.S., at the same time chicken processors exerted more and more control over broiler farmers. Does this mean that broiler farmers are making more money than they would have in, say, 1930? Perhaps, or perhaps not. It is that ambiguity that takes some education to recognize, and is one of the major objectives of this article.

Figures

(1) Screenshot taken from source H1.

(2) Screenshot taken from source C1.

(3) Original photo.

(4) Screenshot taken from source E1.

(5) Screenshot taken from source E1.

(6) Taken from data in source N1.

(7) Screenshot taken from source M1.