Dairy products, surveys, and consumer experiments (part 2)

Vickrey auctions

If the goal of the research is to measure the value consumers place on different milk types, you must actually measure value at some point. Much of the time researchers do so using an auction—but not the type of auction you are accustomed to.

Suppose we want to measure the value consumers place on a specific type of milk, and we do so by auctioning one quart of this milk to thirty research subjects. Most students are used to an auction where the bidding begins at a low price and potential buyers offer higher prices in an attempt to out-bid each other. When the auctioneer finally reaches a price so high that one and only one buyer will pay, the transaction is complete. The person with the highest bid wins, receives the item, and pays an amount equal to that highest bid. This is referred to as an English auction.

When economists measure the value consumers place on a product they do not want to use the English auction, because people tend to bid less than their true value. For instance, if the milk’s true value to you is $3.00 and you bid $3.00 and win, it is like trading $3.00 for $3.00—you neither benefit nor lose from the transaction. Since there is no reason to bid your true value in an English auction, researchers don’t like it. Remember, the objective of the auction is not to sell stuff, but to measure the value of goods to people. Instead, economists want a different auction where people have the incentive to bid an amount exactly equal to their true value. Among the most popular of these auctions is the second-price or Vickrey auction

This is how the Vickrey auction works. Suppose that you are a participant in such a study. There are thirty people in the room and only one quart of rBST milk, and the researcher announces that the milk will go to the winner of an auction. The researcher then reads aloud the following instructions.

- “Please submit your bid on a piece of paper. The bid should be in dollars.”

- “The bids will be held confidential.”

- “After all the bids are submitted, the person with the highest bid will receive the milk.”

- “The winner of the auction does not pay an amount equal to their bid, but the second-highest bid.”

- “It is in your interest to submit a bid equal to the true maximum number of dollars you are willing to pay for the milk.”

- “This is a real auction. Should you win, you must really pay a price equal to the second highest bid.”

If you think about it, your incentives really are to submit a bid equalling the maximum amount you would pay for the good.

- If you bid more than this maximum, you might find yourself paying more for the milk than its value to you. That would be like paying $12 to receive a $10 bill.

- If you bid exactly equal to its true value to you, and you win, then you always pay less than its value and so you benefit from the transaction. It will be like paying less than $10 for a $10 bill.

- If you bid less than its true value then you risk losing the auction despite the fact that you might have won and benefited from the transaction.

There are other auctions researchers use to measure value, but the Vickrey auction is one of the most popular. Once the researcher has collected the bids she can study them to determine the value people place, on, say, milk. For instance, she might average the bids to calculate the average value of the good.

Analyzing results of a Vickrey auction

Figure 1—Milk study by Kanter, Messer, and Kaiser

We will now turn to a real experiment conducted by Kanter, Messer, and Kaiser(K1) (KMK), researchers from Cornell University and the University of Delaware. One of their goals was to determine if the presence of milk with a label saying its farmers pledge not to use rBST causes the value of milk without the pledge to fall. They did this by recruiting a sample of Americans, placed them in a controlled, experimental setting, randomized things they could not control, and used something akin to a Vickrey auction to measure the value of milk with and without the pledge. They also measured the value of organic milk, so it was a comparison of three milk products.

This lecture reviews how the KMK study was implemented and how the auction bids were analyzed to make inferences of milk’s value to consumers.

Implementing the KMK study

SELECTING THE SAMPLE. Ideally, the researchers would travel to different parts of the country to gain a representative sample of Americans, but the expense would have been too large, so they instead recruited people who attend and/or work at Cornell University. Using email announcements and other electronic publications, they offered individuals $15 to participate in one of fifteen sessions, each of which took about an hour of their time. Because of this small amount of money, they are more likely to attract people with smaller incomes, but as I said before, these imperfections are often tolerable.

CONTROLLING THE EXPERIMENT. Regardless of the section they attended, they were given identical written and oral instructions. Subjects were allowed to ask questions, but no communication between subjects was allowed. To make sure everyone had access to similar information about the milk products, they were given handouts containing nutrition information as well as the production practice used on the dairy farm. Each of the three milks were served in clear pitchers with no labels or logos.

All three milk products contained identical levels of fat. (In reality the study compared nine milk products. The three milk products were provided at 0% fat, 1% fat, and 3.25% fat, but for simplicity, we will pretend that all three milks were observed at the same percent of fat.)

RANDOMIZE WHAT YOU CANNOT CONTORL. The auction was conducted on a computer, and each subject was randomly assigned to a particular computer so that they could not choose to sit next to, or choose to avoid, other people they may know.

Each subject was allowed to taste each of the three milks, but as we have discussed, the value of each milk may depend on the order it was tasted. Thus, they randomized the order in which the milks would be tasted. For instance, some tasted the organic milk first while others tasted it last.

CONDUCT A VICKREY AUCTION. In reality, this study didn’t use a Vickrey auction, but something called a BDM auction instead. However, they could have just as easily used the Vickrey auction, and theoretically the bids would have been identical, so let us just pretend the study did use a Vickrey auction.

Each subject was given $5 to use in an auction. They submitted a bid for each milk product, but the research was designed such that the participant knew they could at most buy only one of the products. First the three bids were submitted, and then the researchers randomly chose one of the three milks to actually auction. For instance, if the organic milk were randomly chosen, the researchers would find the highest bid for the organic milk, give the organic milk to this bidder, and make them pay a price equal to the second-highest bid. Because subjects submitted their bids for all three products before one was randomly selected to be the real auction, their bids should equal their actual value for each product, assuming they will buy one and only one of the products.

Measuring the value of milk: use statistical tools to account for things that can be neither randomized nor controlled

There will always be some factors influencing results that cannot be controlled for in the experiment, nor randomized. The demographics of a sample is an example. It is difficult for the researcher to acquire a sample of subjects whose demographics is a perfect reflection of the U.S. For example, females are more easily recruited into surveys and experiments than men, and gender does influence the value of food. In this case the researchers used statistical tools like regression analysis, that allow researchers to measure the particular manner in which a demographic is influencing the results. They can then transform the samples such that they behave as if they were a representative sample.

For example, let us suppose that the sample consists of 80% females and 20% males. On average, females value a certain milk product at $2.00 while, on average, males value that same milk product at $1.00. Because females were 80% of the sample the average value of the milk for the sample is (0.8)($2.00) + (0.2)($1.00) = $1.80. However, if the U.S. population is half male and half female, the average value of the milk product in the population is predicted to be (0.5)($2.00) + (0.5)($1.00) = $1.50. So even though the average value in the sample was not representative of the U.S., a number of statistical tools are available that make the sample behave as if it were representative.

In this study, some of their results are reported taking these demographic issues into account, and some were not.

KMK Result #1

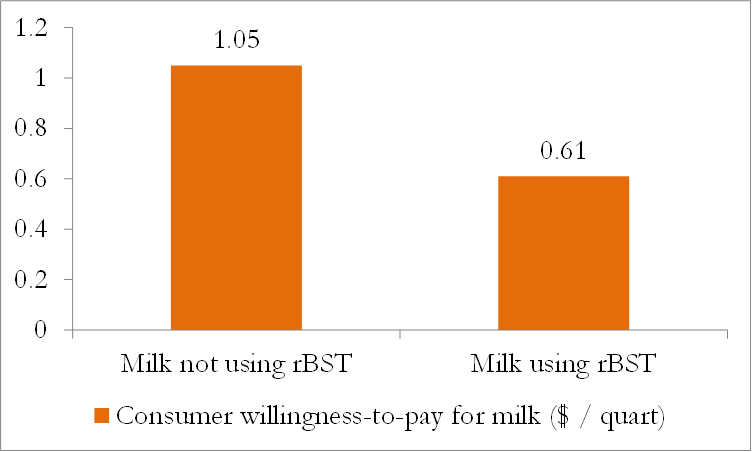

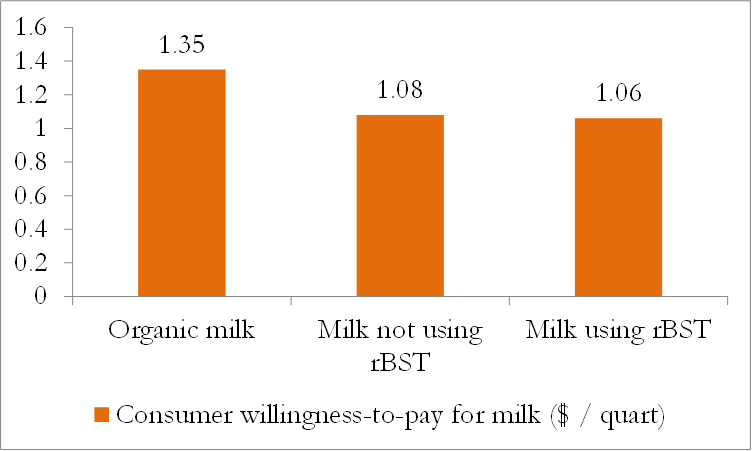

After the experiment was complete the agricultural economists set about calculating how average bids varied among the organic, non-rBST, and rBST milk, as shown below. Consumers clearly place a higher value on organic milk, valuing it at around $0.30 more per quart than the other two milk types. The value of milk with and without rBST is nearly identical, suggesting that consumers are largely indifferent as to whether the farmer uses the rBST hormone or not. Perhaps the presence of non-rBST milk does not lower the value of rBST milk?

Figure 2—Consumer willingness-to-pay (i.e., value) for organic, non-rBST, and BST milk

KMK Result #2

When the researchers investigated further they discovered some evidence that the presence of non-rBST milk indeed stigmatizes rBST milk. They recognized that when non-rBST milk was presented to the subject first, and rBST milk second, the value of the rBST milk was much lower. This suggests than when consumers are first made aware that some farms do not use rBST, and are then presented with rBST milk, they penalize the second milk harshly. Moreover, once statistical tools were used to remove the effect of demographics and other variables (variables that could be neither controlled nor randomized), the discount assigned to rBST became even larger. Thus they concluded that selling non-rBST milk acts to lower the value consumers place on regular, rBST milk.